Medicare

Health insurance for individuals 65 and older or under 65 with a disability.

Confidently Transition to Medicare

When it comes to Medicare, the misleading advertising, the onslaught of junk mail, and the bogus phone calls can create anxiety and fear. We want to empower our clients with confidence as they enter this new healthcare arena.

In its simplest form, Medicare is health insurance that beneficiaries have been paying for their entire working life. Medicare just functions differently than employer plans or individual health insurance. Using open dialogue, education, and your needs assessment, we work together to find plan(s) that best fit your individual needs.

Original Medicare

Unlike individual or employer health coverage where all benefits are covered under a single plan, Medicare separates health coverage into individual parts: hospitalization, doctor visits, and prescriptions.

Learning the Medicare “alphabet” will help you understand your new benefits.

Original Medicare includes Part A and Part B

Part A

Hospital Insurance

Helps Cover

* Inpatient Hospitalization

* Skilled Nursing

* Home Healthcare

* Hospice

Part B

Doctor & Outpatient Medical Insurance

Helps Cover

* Preventative Services

* Doctor Visits

* Outpatient Doctor Services

* Lab, Radiology, Durable Medical Equipment

*IRMAA – Income Related Medicare Adjustment Amount. Higher earners will pay more for Medicare Part B and Part D.

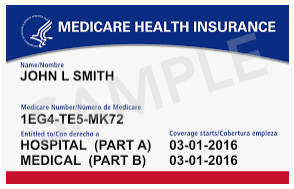

I Have My Medicare Card. Now what?

Whether you are turning 65 or are eligible for Medicare due to a disability or health condition, Original Medicare (Part A + Part B) is designed to cover about 80% of healthcare costs. The remaining 20% can leave Medicare Beneficiaries financially exposed.

Surprisingly, Original Medicare does not cover prescription drugs (exceptions apply), dental or vision benefits. Each enrollee will need to decide how to cover those “gaps”.

Part C – Advantage Plans

-

All in one Alternative to Original Medicare

-

Must be enrolled in Part A and Part B

-

Low Premiums – $0/month plans available

-

HMO & PPO Plans

-

Extra Benefits may be included – Dental, Vision, Hearing, Silver Sneakers, Etc.

- Option to change plans annually

-

Plans sold by private insurance companies

Part D – Stand Alone Prescription Drug Plans

-

Must be enrolled in Part A and/or Part B

-

Helps cover the cost of prescription drugs

*IRMAA applies.

**Prescription drug coverage is required for all Medicare Beneficiaries.

Failing to enroll when first eligible may result in a penalty.

New Medicare Requirements

Effective October 1st, 2022, per Medicare requirements – Medicare phone calls must be recorded.

We do not offer every plan in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

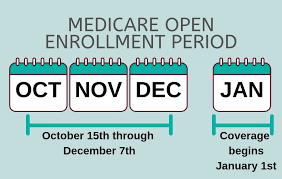

Medicare Open Enrollment

AEP – Annual Enrollment Period – October 15th – December 7th.

This is the time every year that Medicare Beneficiaries can select and enroll in a new Medicare Advantage Plan or PDP – Stand Alone Prescription Drug Plan. Year over year, your health needs change, formularies change, prices change – this is your opportunity to enroll in a plan that will best meet your needs as we enter a new year. Of course, best laid plans cannot predict the future.